The Southern California construction industry is fast-moving, and the one thing you can count on is constant change and having to pay taxes.

If you own or operate a construction company, you know there are unique challenges when it comes to accounting and taxes. While it draws on all the same basic principles of general accounting, the construction industry has its own set of accounting techniques and tax regulations because of the long-term timelines, custom contracts, and unique project-based work.

An accountant specializing in construction needs to understand how to track retainage and change orders. They should know what a pay application is, and what is required. Also, they need to be able to understand job costing, and help you identify which projects are profitable (and which are not).

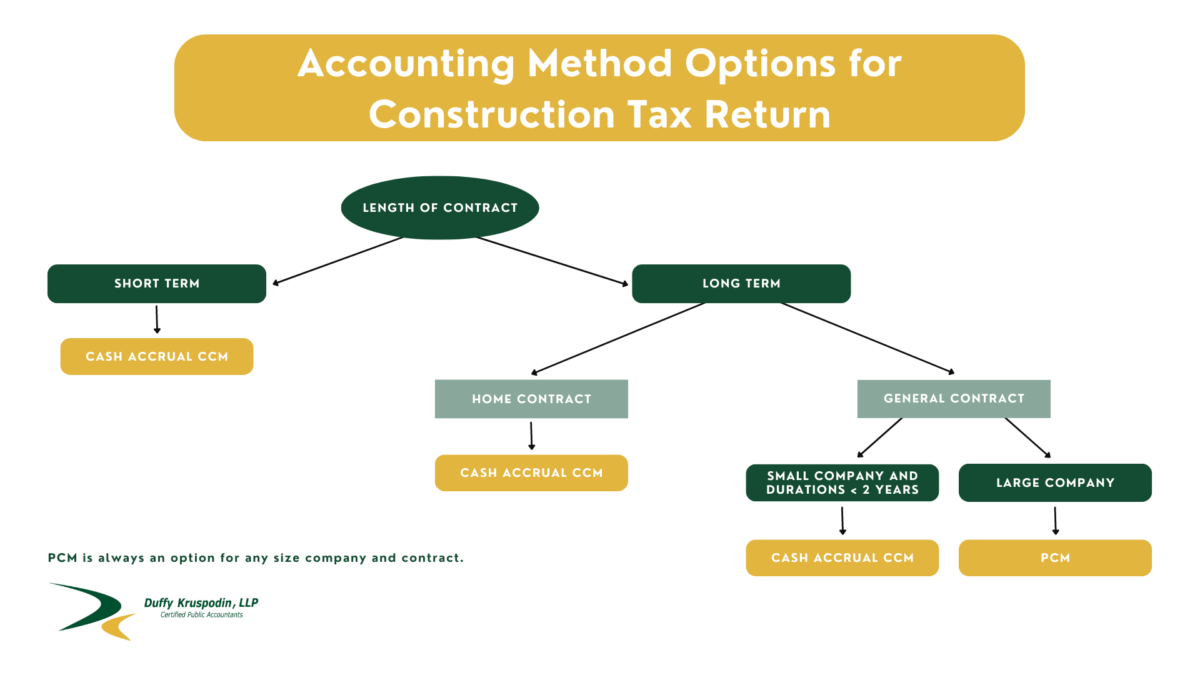

Lastly, they need to ensure that you are using the optimal accounting method to handle your company’s tax deferrals. Deferring tax payments may help your business’s cash flow position. Depending on your business earnings, as well as your typical contract type and length, you can choose from various methods to align tax payments with contract revenue.

The IRS has stated that contractors must select an accounting method that clearly reflects their income, and it offers these four approaches:

- Cash

- Accrual

- Hybrid

- Accrual with Deferred Retainages

Along with selecting an overall approach, contractors must choose an additional accounting accrual method if they have long-term contracts (i.e., a contract that is not completed in the same year it’s started).

These methods include:

- Completed Contract Method (CCM)

- Exempt-Contract Percentage of Completion Method (EPCM)

- Percentage of Completion Method (PCM) or Cost-to-Cost as required by IRC Section § 460

- Percentage of Completion Simplified Cost Method

- Percentage of Completion 10% Method

- Percentage of Completion Capitalized Cost Method (PCCM)

Before you work with your advisors to determine whether switching to one of these methods would be advantageous, an explanation of each of these methods might be beneficial.

Cash vs. Accrual Accounting

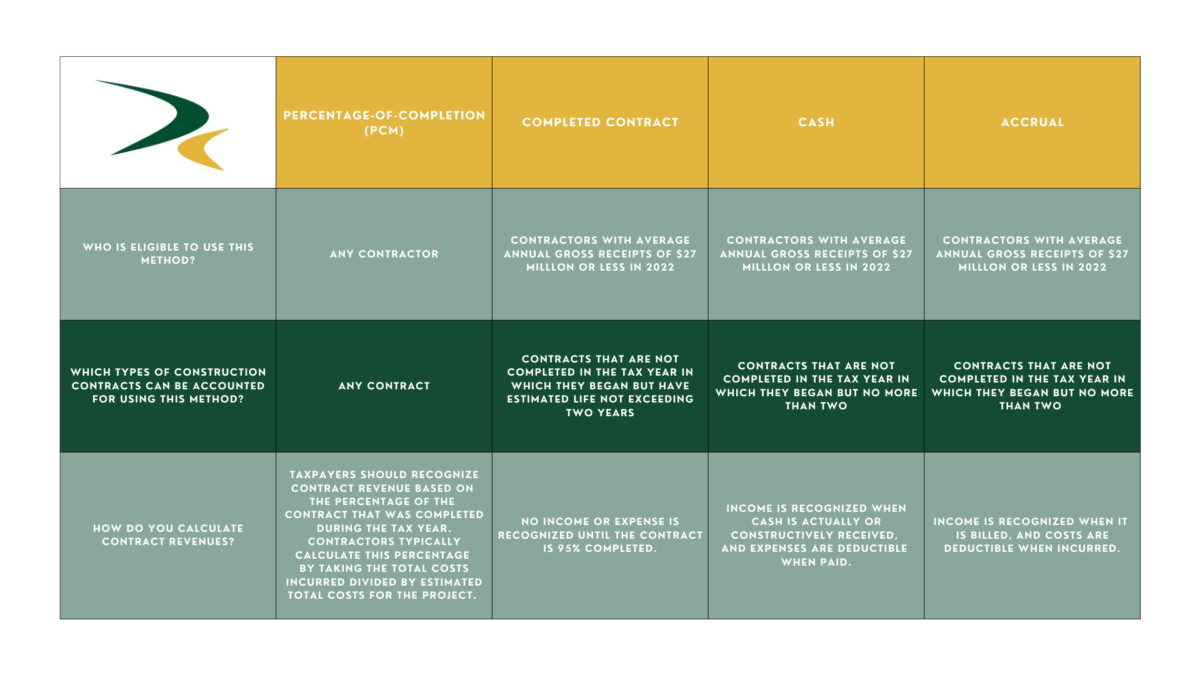

In cash accounting, income is recognized when it’s received and expenses when they’re paid. Most construction companies and contractors use one accounting method on contracts for work started and completed in the same year and another method for long-term contacts.

However, the cash method of accounting for both short-term and long-term contracts can only be used if the company’s average annual gross receipts do not exceed $27 million for the three taxable years preceding the contract and provided that the contract is expected to be completed within two years of the commencement date.

Accrual accounting recognizes income when it’s earned and expenses when they’re incurred. It provides a more accurate description of a company’s economic condition, but it is also more difficult to implement.

Only Accrual Method Complies with GAAP

Unlike the cash method, the accrual method complies with Generally Accepted Accounting Principles (GAAP) issued by the Financial Accounting Standards Board. This is important to note because GAAP compliance is often preferred by lenders and investors. As a result, choosing between cash and accrual basis accounting could be a non-issue for many construction companies given that any contractor that needs to produce GAAP financial statements must use accrual.

Hybrid Accounting

This method combines the cash and accrual methods. For some companies, cash methods can be used for small projects while accrual is used for long-term projects. This can be helpful for companies that prefer the simple approach of cash basis but need to use accrual for GAAP or IRS reporting.

Accrual with Deferred Retainages

This seldom used approach is like the accrual method except that revenue from retainages isn’t recognized until the contractor is entitled to receive it.

Accrual Method Choices

Construction companies need to pick an accounting method in the first year of the contract. The two most common approaches are:

- Completed Contract Method (CCM)

- Percentage of Completion Method (PCM) or Cost-to-Cost as required by IRC Section § 460

Completed Contract Method (CCM)

This method is often used by contractors averaging less than $27 million in annual revenues. Under CCM, all financial activities are deferred until the completion of the contract. The advantage of using this method is that it allows for the maximum deferral of income taxes as revenue is not taxable until the job is complete.

Percentage of Completion Method (PCM) or Cost-to-Cost as required by IRC Section § 460

PCM is generally the required method for financial reporting purposes for larger construction companies (i.e., those with average gross receipts of more than $27 million for the three taxable years preceding the contract) for long-term contracts, as it is the primary method used under GAAP.

PCM matches revenue from long-term contracts with their respective costs, calculating estimated revenue and gross profit at various stages of construction. Calculating gross profit on a regular basis allows contractors to track their progress and provide profitability benchmarks, which can provide timely feedback to allow management to proactively control costs or pursue the most profitable jobs.

The default method of calculating PCM for tax purposes is the cost-to-cost method. Cumulative contract costs incurred through the end of the taxable year are divided by the total estimated contract costs.

The IRS Construction Industry Audit Technique Guide also lists the following PCM variations available for long-term construction contracts:

- Exempt-Contract PCM (EPCM) – EPCM allows the use of any cost comparison method to determine the percentage of completion — such as reviewing direct labor costs incurred to date to total estimated labor costs, or measuring the work performed on the contract with the estimated total work.

- PCM simplified cost method – Smaller construction businesses can elect to determine a contract’s completion factor based on only certain components of costs versus all allocated costs.

- PCM 10% Method – Under this method, a contractor may elect to defer recognition of revenue under PCM until the contractor incurs 10% of the total estimated allocable contract costs. Every contractor subject to PCM should make this election.

- PCM Capitalized Cost Method (PCCM) – PCCM applies mainly to residential construction. It allows residential construction contractors to report 70% of a contract under the PCM and report the remaining 30% under any exempt method, such as CCM or cash.

Summary

As you can see, choosing what method is right for your construction company can be complex and can play an integral role in your company’s success. In addition, you may want or be required to change methods as your business grows. As a result, it is a good idea to occasionally review your accounting method options to determine whether you are making the optimal choice for the contract in question.

Often the best answer is a not a simple yes or no, but a strategy developed just for you. If your construction business has not reviewed its overall method of accounting and long-term contract methods, contact a tax leader in DK’s construction industry group. We can develop a personalized strategy for your business as well as answer any questions you have about the methods described above or any other aspect of accounting or tax reporting for construction businesses.

You can download a PDF of this article here: Tax Accounting Methods for Construction Companies and Contractors