Passing assets to the next generation can feel overwhelming.

The idea of providing a legacy, generational wealth and a financial foundation for children and grandchildren is incredible in theory but creating the right situation for every heir can be stressful.

This can get even more difficult when you have a large nest egg in an individual retirement account. An IRA is a tax-friendly tool for saving assets. You generally have to start taking withdrawals from your IRA, SEP IRA, SIMPLE IRA, or retirement plan account when you reach age 72 (70 ½ if you reach 70 ½ before January 1, 2020). Roth IRAs do not require withdrawals until after the death of the owner.

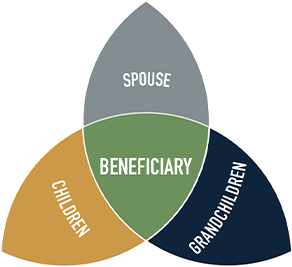

If you withdraw the minimum each year, there will likely be money left in the IRA at death which will go to whomever you name as a beneficiary, commonly your;

But is there a more efficient way to pass on these assets? Enter a trust.

But is there a more efficient way to pass on these assets? Enter a trust.

The truth is trusts can be an excellent estate planning tool to protect and preserve your wealth for generations.

A trust can inherit the IRA and is maintained as a separate account that is an asset of the trust. This will help you work around the beneficiary ownership limits of an IRA and can potentially solve for any unique family situations, like a second marriage or a child with special needs.

Do you have (or do you know someone that has) a large IRA and are only taking the required minimum distributions?

Let’s have a conversation and determine if this strategy may be suitable for you.